14 October 2024

Infront Assetmax: New Features & Upcoming Releases

In this update we will share exciting updates and innovations from Infront Assetmax. Our WealthTech offering continues to evolve rapidly, with new features and integrations to enhance your experience. Infront Assetmax is a key component in this offering.

Highlights include:

- Comprehensive improvements in Investment Proposal

- CoreData API integration and more functions on data quality

- Weekly release cycles and overview of all improvements

- Expansion into Europe and language expansions

- Cloud Readiness

- Expansion Custody and Order Interfaces

- WealthPortal updates

Keep reading for more insights on all these new features and how they benefit your work.

Investment Proposal Features

Assetmax's investment proposal feature offers a guided process for creating new or modifying existing investment portfolios. In our most recent iteration, we've enhanced the portfolio rebalancing component and integrated an ex-ante/ex-post risk analysis widget. Looking ahead to next year, we plan to introduce functionality that will enable automatic copying of investment proposal transactions directly into the client's portfolio.

CoreData API integration and more functions on data quality

CoreData API is Infront’s API engine connected to our Global Data Universe with all financial instruments data coverage. All Infront products tap into it when functioning as market data terminals, sending data to our customers via data feeds or applying the data into business logic used in trading gateways or portfolio management solutions.

Infront Assetmax uses this Global Data Universe and is constantly adding financial instruments. On the roadmap for Q1 2025 is expansion of corporate actions, credit ratings and Swiss structured products. Already 25% of all Assetmax customers in Switzerland have signed up for Infront’s market data since the coverage is broad and offers substantial savings.

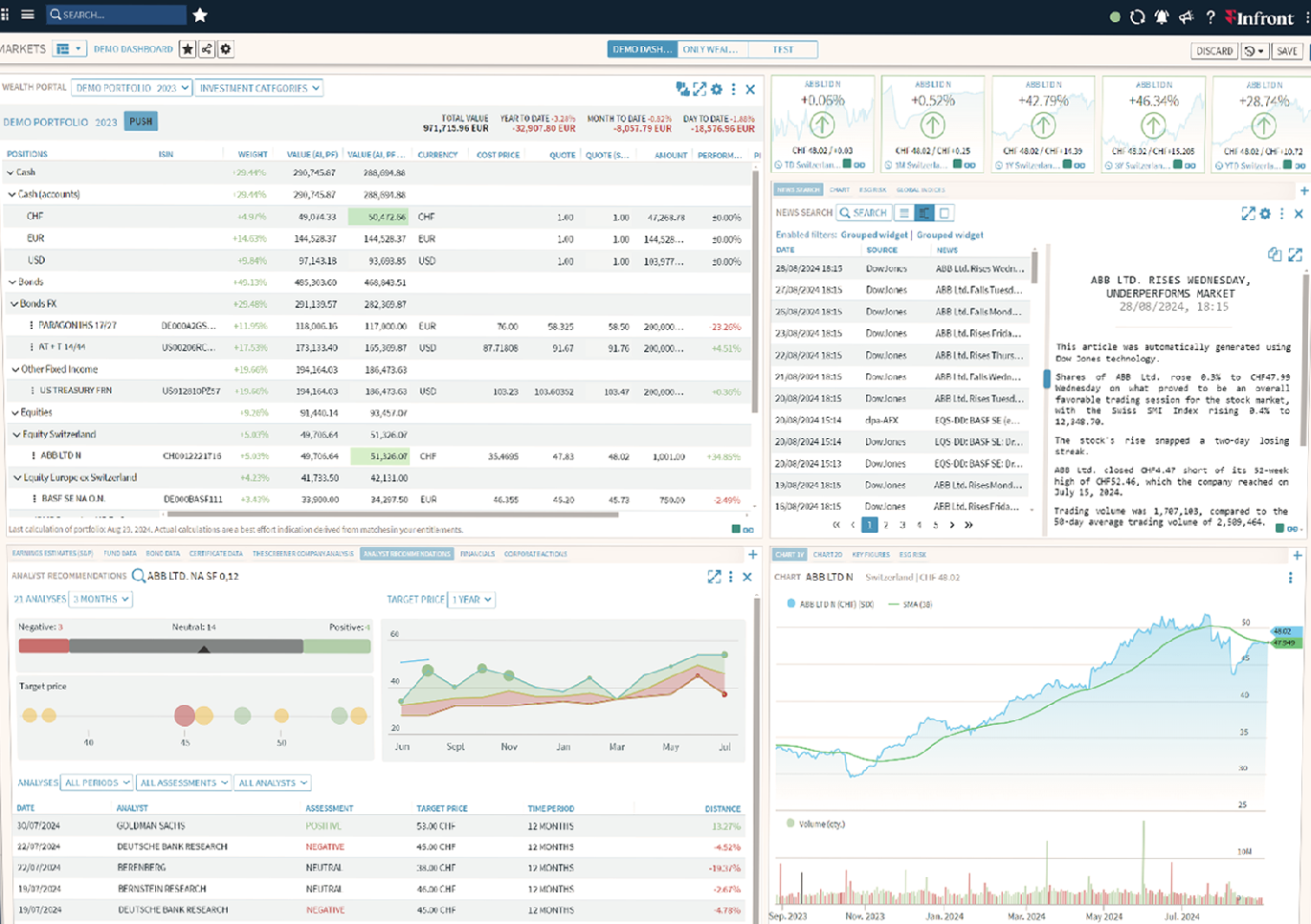

It is also bundled with the Infront Investment Manager (IM) terminals with real-time market data. And in Q4 the optional Portfolio Widget that comes with the terminal will be able to show Assetmax portfolios in the terminal with real-time market data. This enables better advice for your UHNWI clients with the combination of IM, real-time data and Investment Proposal offering a “wealth” of better insights.

Weekly Release Cycles and Other Improvements

Infront is investing signifcant development hours and budget into our WealthTech offering and Assetmax is a key component of this. Assetmax maintaisn a weekly release cycle. It is at the customers and the consulting team's discretion to determine when a new Assetmax version should be installed.

Our objective is to ensure that all clients are utilising the most up-to-date version of Assetmax, with no version older than six months in deployment.

In 2024 alone, we have implemented a substantial number of 439 improvements, encompassing bug fixes, minor enhancements and significant new functionalities.

The major features released are illustrated in this chart.

First, we have considerably enhanced the attribution calculation by incorporating benchmark portfolios composed of indices at the category level. This enhancement is particularly valuable for institutional clients.

We have also introduced the capability to calculate NAV for each portfolio. This feature is beneficial for utilising an existing portfolio as a reference index (benchmark) or for managing a portfolio akin to an investment fund.

Another significant functionality is data freezing, which enables the prevention of any modifications to portfolio data prior to a specified date. This is particularly advantageous for institutional portfolios, ensuring data integrity after the issuance of an official yearly report.

Other recent feature additions include:

- New rebalancing algorithms, notably the option to allocate cash flows within a specific portfolio category (e.g. solely in equities)

- An export query named "All Mandates", designed to export all data requisite for a regulator audit

- A new main dashboard that serves as a start page that provides a summary of all mandates and open issues, such as PEP checks, restriction breaches and other pertinent matters

- New risk widgets, including a drawdown chart and benchmark risk figures

- Robust support for private equity, and we are continually enhancing it. For instance, we have added cost price calculation and fee clawback functionalities

- A refined cash flow projection functionality to permit the manual addition of cash flows

- Introducing user-defined fields, enabling the addition of custom information, for example, to positions

In response to Worldcheck's (LSEG) price increase, we have integrated support for SGR, a Swiss provider of PEP information. Development is nearing completion.

We are in the process of implementing support for limit orders.

As described we are launching the integration with Investment Manager. This will facilitate the intraday valuation of Assetmax portfolios, encompassing the utilization of advanced analytics and market news.

In collaboration with our partner SwissComply, we are comprehensively reviewing our compliance package, which includes KYC forms, IP forms, and other relevant documents. We are also reevaluating our proprietary risk model to incorporate new risk factors and scenarios.

In conclusion, we have made substantial progress in 2024 with numerous enhancements and new features. These advancements benefit a wide range of clients, from institutional investors (banks, asset managers and wealth managers, family offices and private equity firms.

Our ongoing development and focus on data integration, risk management, and compliance ensures that Assetmax remains a potent and adaptable tool for investment management.

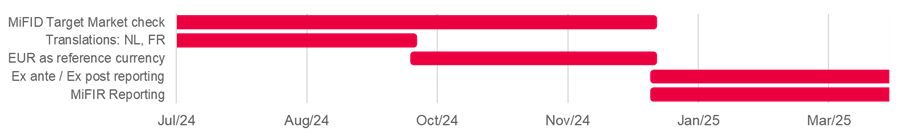

Switzerland’s Finest, Now for All of Europe – More Countries and Language Support

As part of Infront's plan, we have begun our expansion into the EU with Assetmax and have acquired our first clients. To this end, we are enhancing Assetmax to support MiFID: Target Market (planned for Q4) and Reporting (along with ex-ante and ex-post analysis functionality). We have added translations in Dutch, French and have "Germanized" our main concepts while we kept improving on our Italian and Swiss German. Finally, we are working on removing CHF as the default currency for some functionality and queries.

Cloud Readiness

Cloud support has different levels of “depth”. The first is "installing Assetmax in a cloud location," and the second is "making Assetmax fully cloud-compliant"—that is, with resource scalability and flexibility, redundancy, multi-tenancy, and so on.

This second level is much more complex and costly to implement, but we are convinced it is the future, as we can see from all major software providers worldwide, such as Microsoft with Microsoft 365. This is because only with such a setup can we take active ownership of the infrastructure and guarantee a standard for cybersecurity, compliance rules, data protection, and system uptime.

With AWS as our chosen Cloud infrastructure provider, all data will be stored in Switzerland or in EU zones for the relevant countries. Infront since acquiring Assetmax have invested significant budget to make Assetmax a multi-tenant wealth-as-a-service platform with infrastructure efficiency and strong Cyber Security that also supports the upcoming DORA regulation requirements.

Expansion Custody and Order Interfaces

Since a Portfolio Management system relies on high quality data for reconciliation purposes on transactions and also needs solid bank connectivity for orders that come out of the rebalancing process, the Infront Assetmax team has invested a lot of development time here too. 56 of our parsers have undergone 170 improvements. We’ve also will integrate 60 additional parsers for German custodian banks into the Assetmax middleware and in Q4 will also enable Infront FIX Hub (IOM) that adds another 40 order interfaces.

An impressive series of Order Interfaces will be added on top in Q4 in addition: Tellco, Morgan Stanley, Banco Stato, Credit Suisse (Bulk Orders), OpenWealth, PKB, VP Bank, Bitcoin Suisse, UBP and Dreyfus.

And more Custodian interfaces are lined up with Lombard Odier’s new format, Tellco, AscentFunds, Lienhardt & Partner, Raiffeisen, Mediobanca, LLB Austria, SAXO, ABN-Amro and Quintet (Insinger).

Wealth Portal – Next Level Client Engagement

The Infront Wealth Portal is a user-friendly, fully brandable client-facing application. Launched to customers in Germany at the beginning of the year, we are now onboarding the first Swiss clients. Please contact us if you would like to take advantage of the expanded availability of our Wealth Portal solution.

If you want to be the first to know about our product updates as they launch, follow us on LinkedIn.