Simplify wealth, maximize potential

Portfolio Management & Advisory solutions designed to simplify workflows for Independent Asset Managers, Family Offices and Banks.

Get in contact to discuss how we can help grow your business.

Local Partner. European Leader

500+

Clients

500k+

Wealth accounts managed

€200 Billion

AuM within our tools

From client onboarding to everyday operations

Our Portfolio Management & Advisory solutions streamline client management from onboarding through reporting, ensuring efficiency and compliance at every step

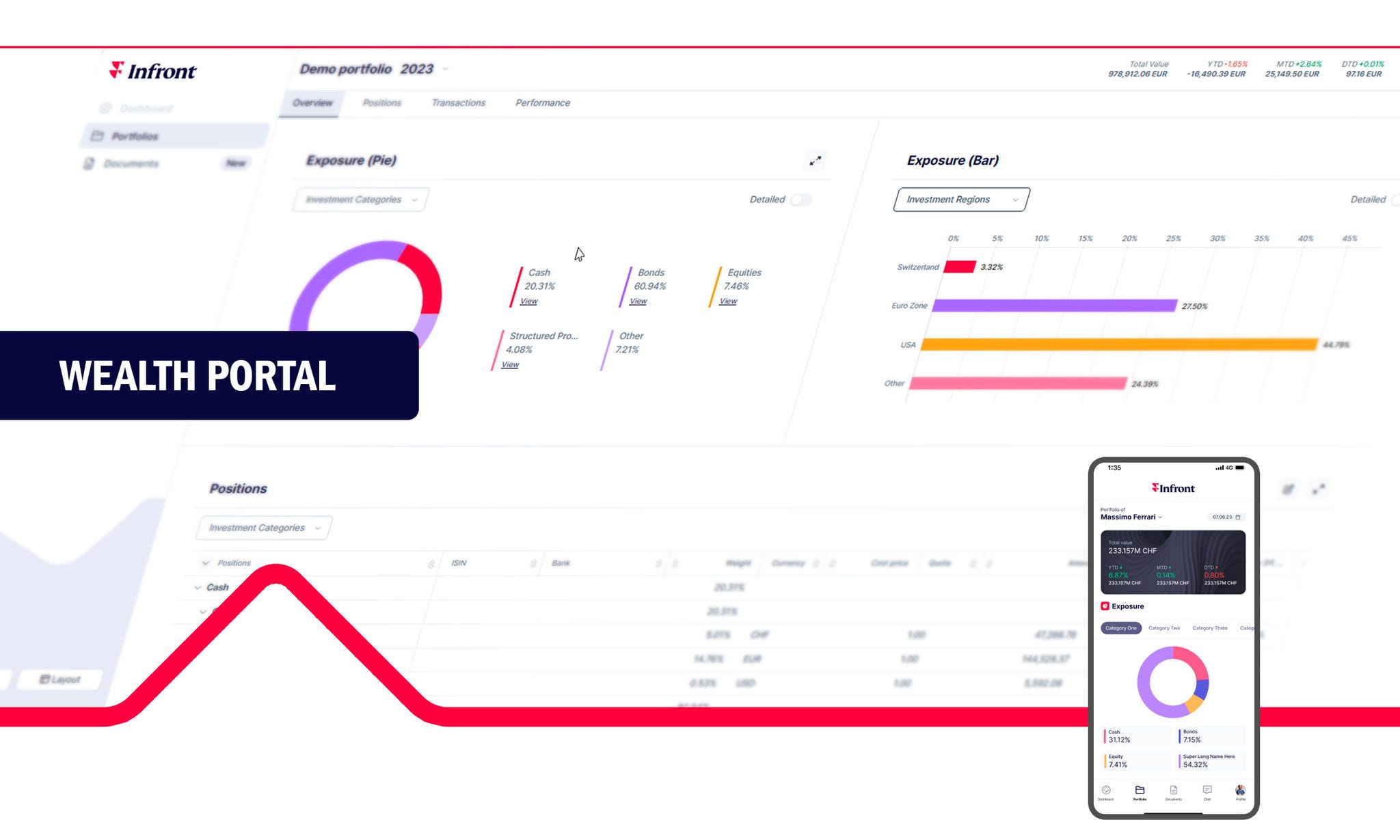

WEALTH PORTAL

State-of-the-art in client engagement

Wealth Portal is our white label, cloud-based web application, tailored to empower end-clients to access portfolio information, share documents, and facilitate seamless communication

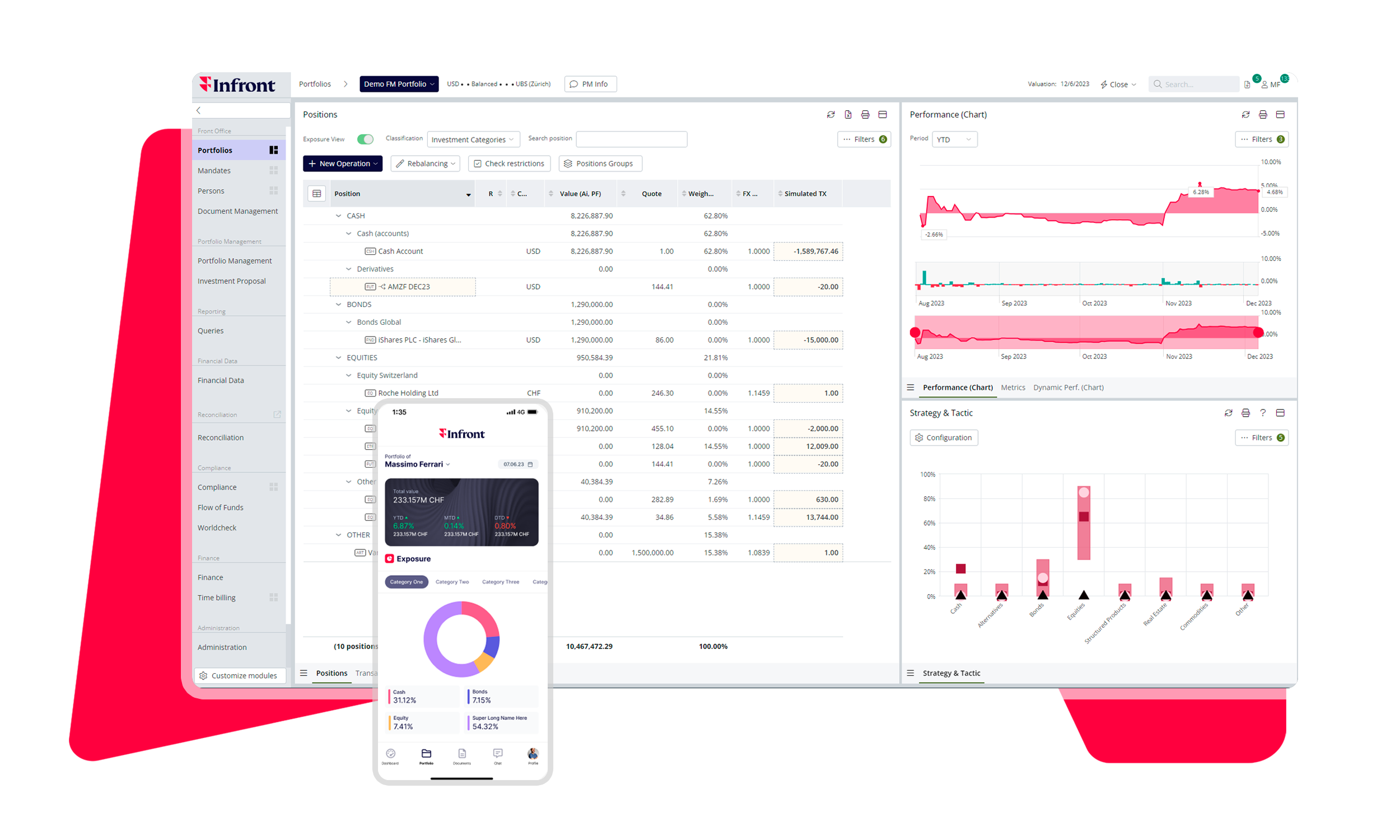

Manage portfolios of any complexity

Easily view and manage portfolios covering:

-

Investment goals and restrictions

-

Asset allocation

-

Performance, exposure and asset overview

-

Risk analytics

-

Model portfolio rebalancing and ordering

-

Multi-custody consolidation and transaction handling via FIX

-

Support for non-bankables, such as private equity

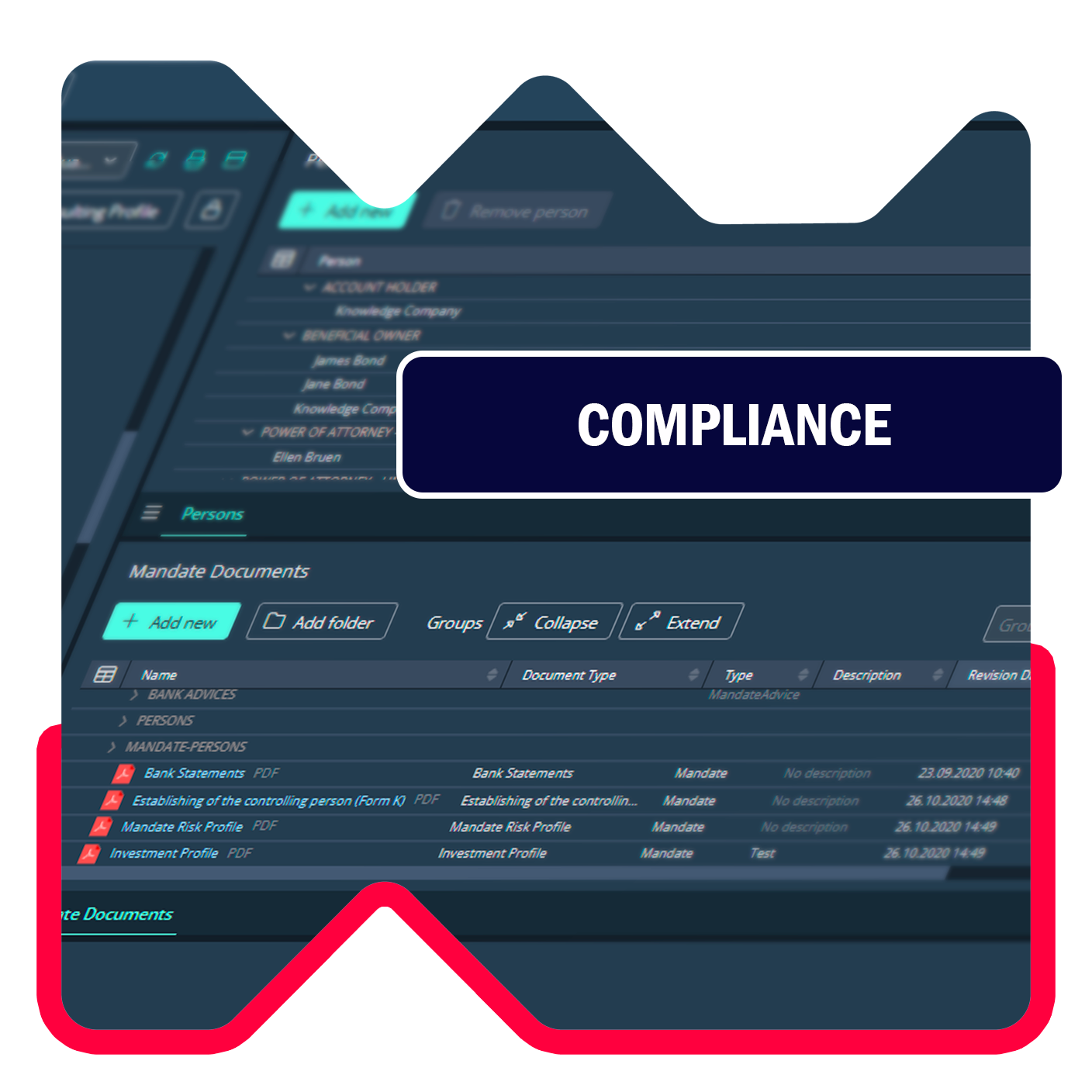

Comply with regulations

-

MiFID II and FinSA regulation-compatible CRM with KYC, investor profile forms and document management

-

AML support including flow-of-fund checks, risk calculation, PEP checks

-

Suitability and appropriateness checks

-

Full audit log

-

EU GDPR and Swiss Data Protection Act compliant

Streamline invoicing and elevate your reporting

Invoicing

- Parametrize and calculate management and performance fees

- Issue client invoices

Client reporting

- Issue modern and configurable client reports in several languages

- Brand the reports to match your corporate identity

BPO services

Outsource data excellence

Our data management outsourcing services include:

-

Automatic detection, correction, enrichment, and normalization of data

-

Manual intervention for handling non-standard banking information, such as varying formats of corporate actions

-

Comprehensive data management services to handle daily quality maintenance tasks

-

Unique transaction-based reconciliation for accurate portfolio impact analysis

APIs for Professional E-Banking

We provide comprehensive access to wealth management functionalities via Web Service APIs.

Features include:

- Multi-custody data consolidation, transaction simulation, and rebalancing

- PEP checks, fund flow checks, KYC validation, and various financial calculations

- Ideal for creating e-banking platforms for professionals or online investment portals

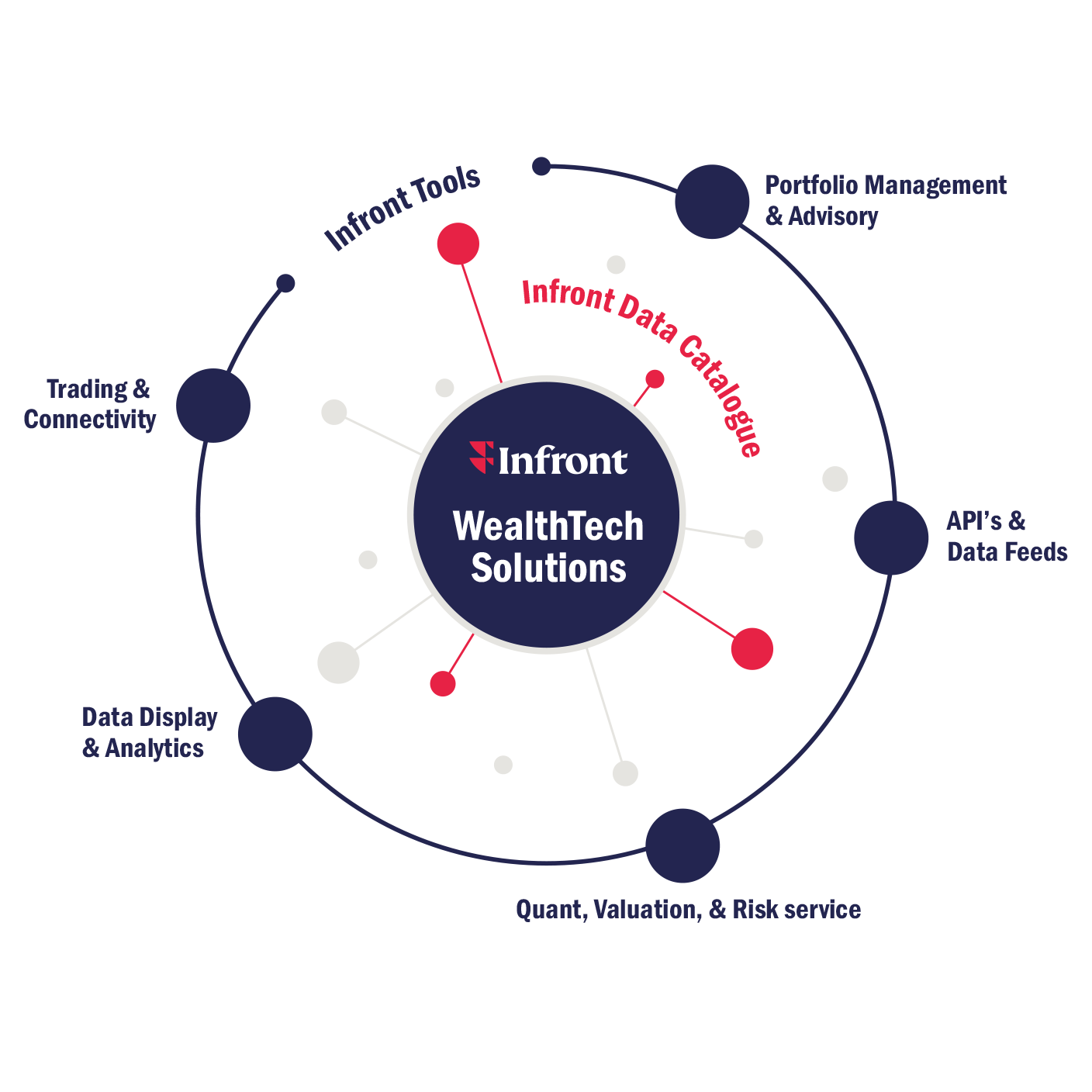

Become part of the Infront ecosystem

Infront WealthTech solutions allow wealth managers to extend their portfolio and advisory solution with the full spectrum of Infront services:

-

Curated data catalogue

-

Powerful market data and analytics tools

-

Risk and valuation services

-

Order Management and custody connectivity