INFRONT FOR FAMILY OFFICES

Built for Complex Wealth. Made for Family Offices

Today's family offices face mounting complexity: multi-custody relationships, alternative assets and rising wealth owner expectations for transparency across generations. Yet 72% remain underinvested in operations technology, according to Deloitte research. With limited headcount managing billions in AuM, the costs and risks of outdated systems have never been greater.

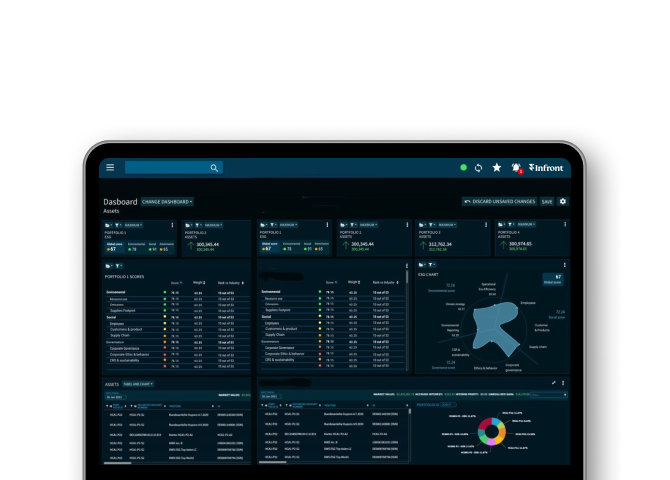

Infront brings together portfolio oversight, compliance, reporting and engagement into one secure platform that grows with your needs.

Total Portfolio Visibility

- Unified view across every asset and custodian: From listed securities to private equity, real estate and bespoke mandates, all in one place.

- Seamless multi-custody aggregation: Automatically consolidate data across banks and custodians to eliminate manual reconciliation.

- Advanced performance analytics: Track both money and time-weighted returns, compare against custom benchmarks and demonstrate clear value to wealth owners.

Local Partner. European Leader

500+

Wealth management clients

500k+

Wealth accounts managed

€200 Billion

AuM within our tools

Why Leading Family Offices Choose Infront

-

Built for wealth professionals: Developed specifically for the needs of wealth and family office teams, not adapted from other sectors.

-

Everything in one place: Replace fragmented tools with one platform that covers portfolio management, client engagement, risk and operations.

-

Partnership mindset: Our specialists are here for you from onboarding to training and ongoing support, with a focus on what works for your business.

Integrated Solutions

Deliver clarity, security and engagement for all stakeholders.

Automated reports provide comprehensive performance and holdings updates that save hours of manual preparation. For enhanced client engagement, a white-labelled Wealth Portal offers wealth owners a mobile-first view of their investments – so each family member sees exactly the information that matters to them.

Free your team from repetitive admin with end-to-end workflow automation, centralised document management and a configurable fee engine. So you can focus on what matters: growing and protecting family wealth.

Start where you are, scale when you’re ready. Infront’s open API architecture and cloud-first deployment integrate seamlessly with your existing systems, while enterprise-ready performance supports even the most complex portfolios.

Part of the platform

Solutions trusted by thousands of Family Offices, banks and wealth management firms.