7 March 2024

What makes a great portfolio management system?

Choosing the right portfolio management system is a key business decision for wealth managers, family offices, private banks and advisors. How you identify risk, manage portfolios and interact with clients – all depend on your technology. And choices made during procurement can have significant long-term impact on everything from costs to customer satisfaction.

Add in the trends of digitalisation in finance and the transfer of wealth to younger, digital-savvy generations and it’s clear that choosing the right tech is essential for anyone managing wealth in 2024 and beyond.

Let’s explore the essential features of the best portfolio management systems and some of the things to watch out for when choosing a platform.

Investment portfolio tools: A clear overview

At the core of a portfolio management system (also known as a PMS) is the ability to build and manage portfolios of assets. This sounds like it should be a feature all platforms would share, but there can be a lot of differences when it comes to the fine detail.

The basic functionality most wealth or asset managers will be looking for in a PMS is a central dashboard that gives a clear overview of investment goals and performance. But for high-net-worth individuals and more innovative investors, a much greater level of complexity is needed.

A good portfolio management tool should also allow for asset allocation across multiple asset classes, complex investment strategies and monitoring of risk analytics.

More advanced PMS features include the ability to model portfolio rebalancing, actively make transactions via a protocol such as FIX, and support for non-traditional investments like private equity or real estate.

A system that simplifies all these processes can significantly enhance portfolio management efficiency.

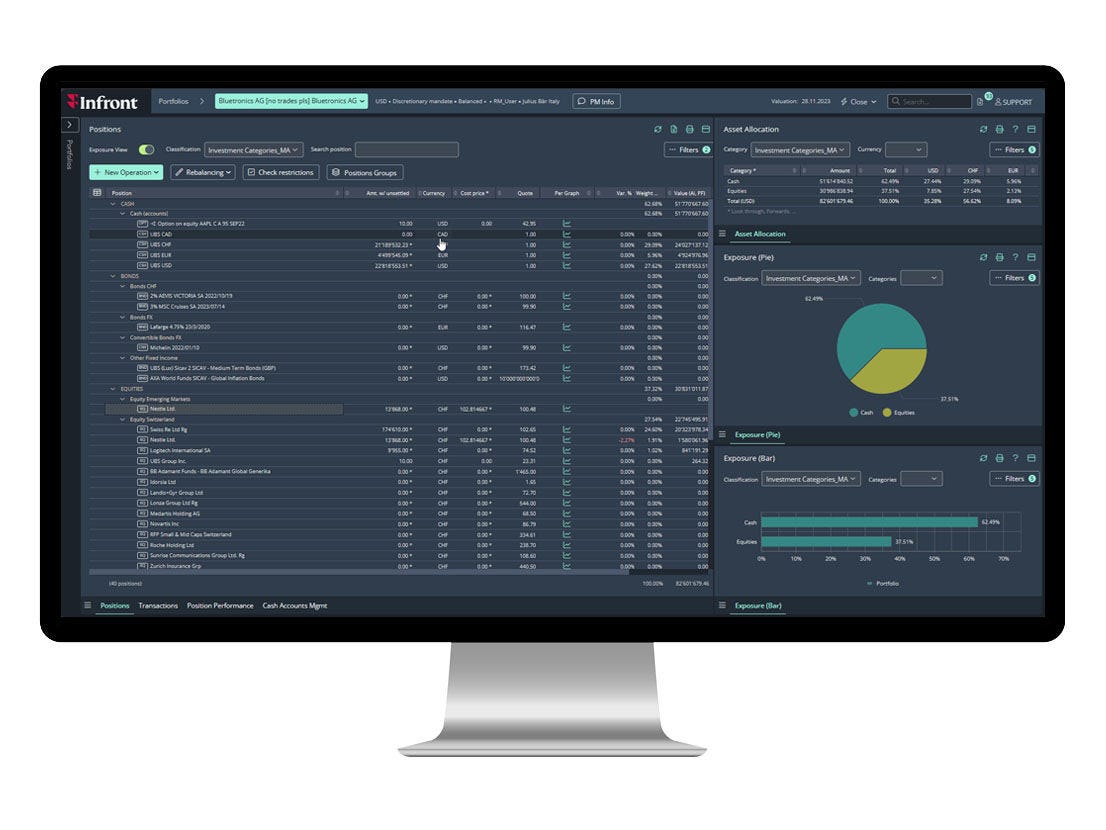

Portfolio overview in Infront Assetmax

Portfolio overview in Infront Assetmax

Connect with clients

Wealth management isn’t only about building successful portfolios. Attracting clients, understanding their needs and building strong relationships with them are all essential for any firm to thrive in the modern marketplace.

An effective system should offer robust advisory and CRM functionalities to help wealth managers understand their clients better and provide tailored advice. With such features, wealth managers can build up and record client profiles and easily manage documents and invoicing.

More advanced platforms even allow for workflow automation – for example for the process of onboarding a new client – which help streamline the advisory process and ensure a seamless experience for both advisor and client.

Offer a client portal

Some investors will want an extra level of visibility into their portfolio. This expectation is only growing as we all become more reliant on apps and digital services that offer flexibility and 24/7 access.

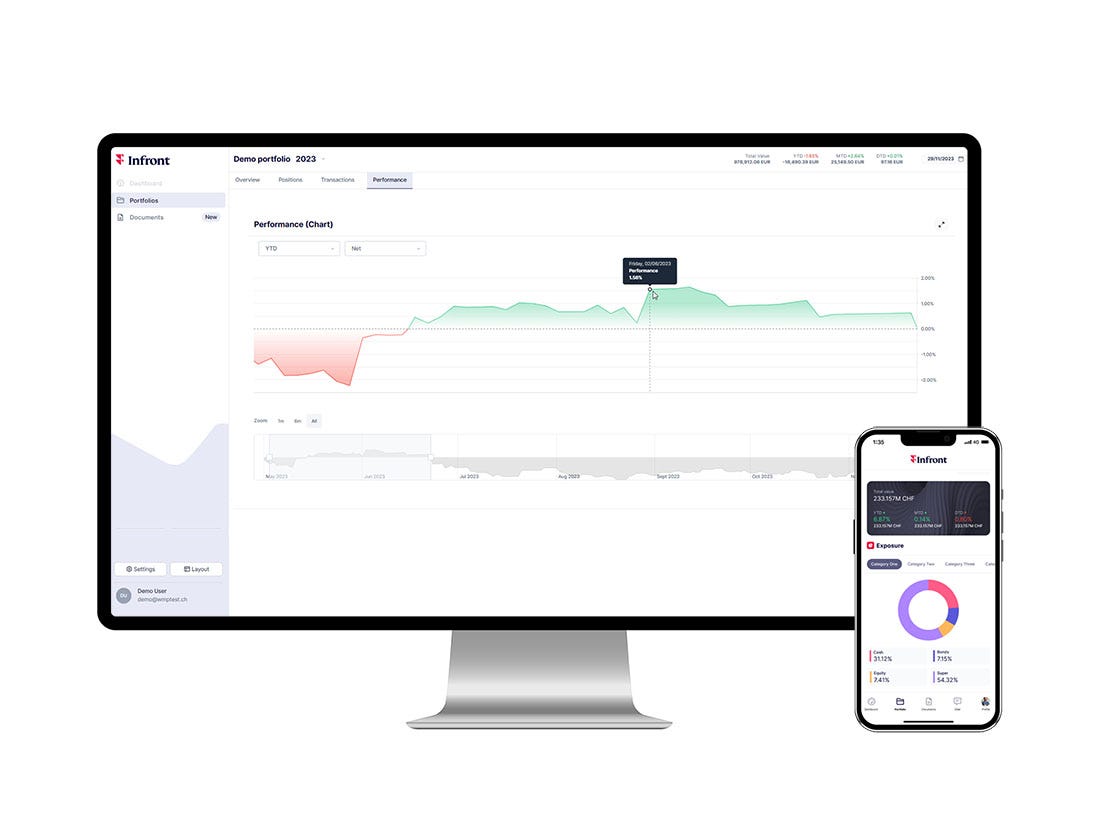

Fortunately, advisors don’t need to build their own wealth management app as tools like Infront Wealth Portal offer a fully customisable white label solution that lets end-clients access portfolio information, communicate with their wealth manager and share documents.

Remember that the client’s experience using the portal you provide them with will have an impact on customer satisfaction and loyalty. So make sure your chosen platform offers a user-friendly interface, is reliable and works on both desktop and mobile devices.

Infront Wealth Portal provides anytime insights to investors on both desktop and mobile

Infront Wealth Portal provides anytime insights to investors on both desktop and mobile

Stay on top of regulations

With the financial industry heavily regulated across Europe, a great portfolio management system must ensure compliance with current regulations.

Regulations will vary depending on where you and your clients are operating. Important features to look for include a MiFID II and FinSA compliant CRM with support for KYC processes, investor profile forms, document management and a full audit log. Anti-money laundering features include flow-of-fund checks, risk calculation and PEP checks.

And since you will be handling your clients’ personal data, make sure any system is fully EU GDPR or Swiss Data Protection Act compliant.

Embrace the system perspective

Portfolio management is only one part of the ecosystem of financial markets and services. The ability to integrate seamlessly with a broader network of banking platforms, APIs and third-party services enriches the wealth management process.

When working together with the right partner, wealth and asset managers can leverage even more capabilities to gain an edge with their investment strategies or create an enhanced customer experience.

For example, market data can be purchased as part of a PMS, which typically offer end-of-day insights into market movements for the purpose of portfolio valuations. If you need market data with your PMS, be sure to check who provides this data and the terms of any contract. If a PMS provider does not offer its own data, it is likely you will need two separate contracts for the platform and data with the resulting extra costs and complexity.

And with an advanced solution that offers APIs and a comprehensive data catalogue, you can customise your system even further, creating your own e-banking platform or incorporating real-time data into your decision-making process for active investment management.

If you need this sort of enrichment of your portfolio management system, it’s sensible to choose a partner with a broad range of financial software products and experience, as well as a commitment to open API standards.

Wealth management technology by Infront

For independent asset managers and wealth managers, it’s clear that a portfolio management system has to offer more than just an overview of assets under management.

The right platform can be critical to offering a winning customer experience, complying with constantly evolving regulations and even opening up a wealth of customisation possibilities through APIs and data feeds.

Discover how Infront portfolio management and advisory solutions can redefine your wealth management strategy for a digital world.