4 February 2025

The Case for 360° WealthTech

Why Wealth Managers Need to Embrace 360° Platforms Now

Wealth managers are at a crossroads. As trillions in assets prepare to shift across generations, firms are facing mounting regulatory pressure and evolving client demands. The question isn't whether to innovate but how quickly.

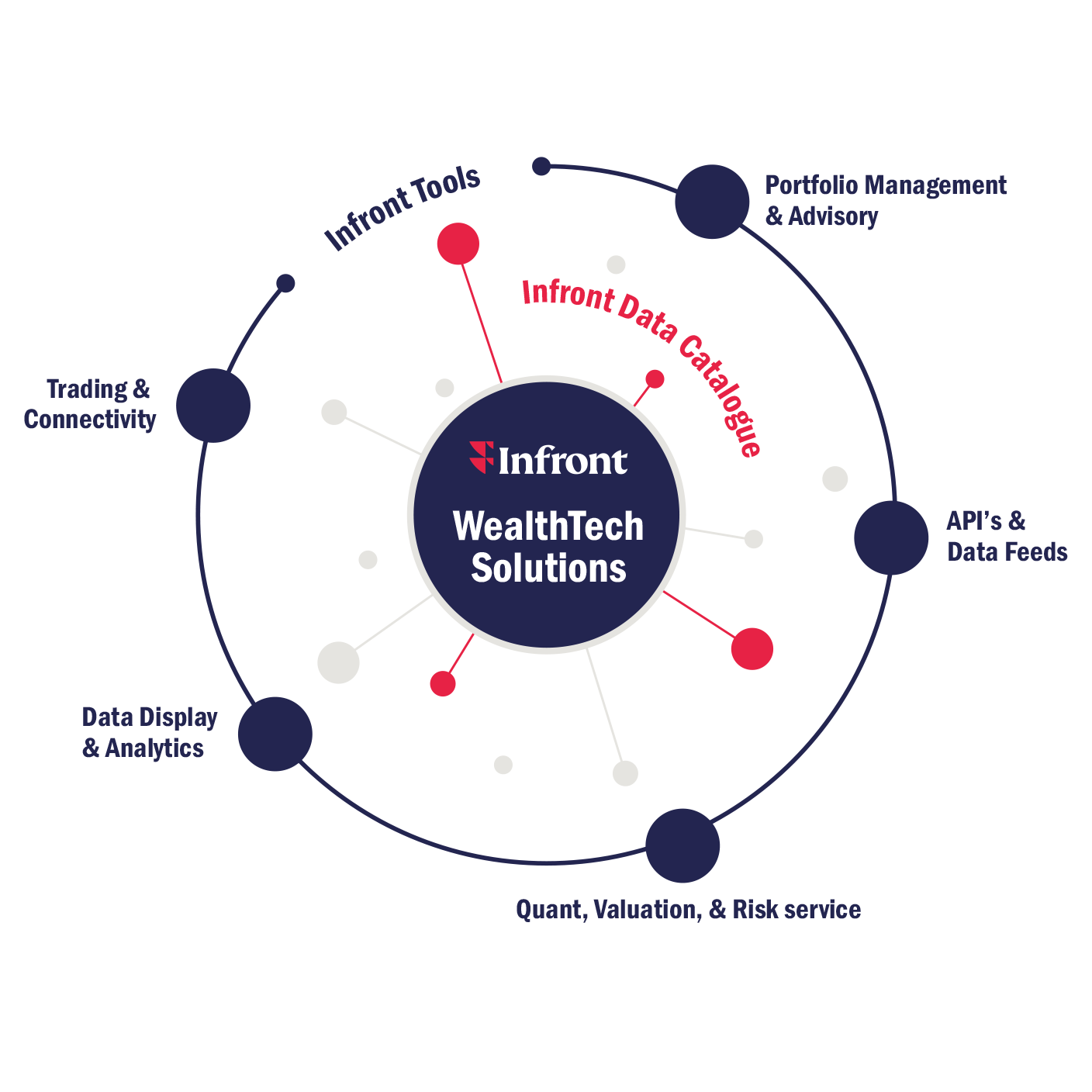

A 360° wealth platform – which integrates data, client interactions, compliance, and trading into a single ecosystem – offers the competitive edge firms need to stay ahead. But the case for change is more urgent than many think.

Addressing Legacy Challenges

Wealth managers face mounting pressure to streamline operations and enhance client experiences. However, legacy IT systems and manual processes continue to weigh on productivity. A significant 60% of relationship managers’ time is spent on non-revenue-generating activities1, due to inefficiencies and fragmented data.

These outdated systems not only hinder profitability but also lead to disjointed client insights. Investors are demanding a consolidated view of their portfolios, yet 44% report they cannot see all their assets in one place2. As compliance costs rise and regulatory requirements expand, the inability to integrate data effectively exacerbates operational stress.

By transitioning to a 360° platform, wealth managers can streamline critical processes – from onboarding to trading – boosting efficiency and profitability. Platforms like Infront's Assetmax consolidate 150+ custodian banks, delivering data and insights that streamline workflows and enhance client engagement.

The Generational Wealth Shift

The industry stands on the brink of a massive wealth transfer. In the next decade, trillions of euros of wealth will pass between generations in Europe. This shift places client loyalty at risk, with 90% of heirs changing advisors post-inheritance 3.

The next generation expects a different experience from their wealth managers. Digital-first, intuitive platforms are no longer a bonus for investors – they are essential. Many younger clients switch to user-friendly, integrated services.

Wealth managers that embrace 360° solutions are better positioned to meet these evolving expectations. Platforms such as Infront's Wealth Portal offer end clients portfolio visibility via mobile and web interfaces. By securing multi-generational relationships through enhanced digital experiences, firms can ensure continuity and mitigate client attrition.

The Benefits of a 360° Platform

Implementing a 360° platform delivers measurable benefits across productivity, revenue, and client satisfaction. Wealth managers who have adopted future-proof technology report4:

- 13% productivity gains

- 8% growth in assets under management

- 8% revenue increases

A key benefit of adopting a 360° platform is that tools not only integrate seamlessly, but add value by working together. For example, the combined capabilities of Infront’s Assetmax, Investment Manager and market data APIs unlock real-time data for end clients in the Wealth Portal tool.

Moreover, a 360° approach can consolidate risk management, valuation, and trading into a single ecosystem, driving operational efficiency.

Compliance in Focus

As regulatory frameworks tighten, compliance has become a significant pain point. Licensing requirements such as FINMA have resulted in a reduction in the number of wealth managers in recent years. Smaller firms struggle to manage rising compliance costs.

A 360° platform simplifies compliance by embedding regulatory requirements across the wealth management workflow. Infront Assetmax, for example, features automated KYC procedures that standardize client onboarding. And being FIDLEG and MiFID II-ready, Infront Assetmax ensures seamless adherence to evolving standards at every step in the client lifecycle.

Why Wealth Managers Must Act Now

Like any industry, the future of wealth management depends on the ability to adapt. Firms that delay risk obsolescence, while those investing in digital transformation gain competitive advantages.

As wealth transfers accelerate and regulatory pressures mount, the need for scalable, efficient, and client-centric solutions becomes ever more important.

Wealth managers must act decisively to future-proof their operations. By investing in comprehensive platforms like Infront’s WealthTech solutions, they can unlock sustainable growth, secure multi-generational relationships, and navigate the complexities of modern wealth management with confidence.

1. McKinsey, Analytics transformation in wealth management

2. ThoughtLab, Wealth and asset management 4.0

3. WealthBriefing, The Great Wealth Transfer: Three Trends Reshaping Wealth Management

4. Liferay, The State of Digital Transformation in Wealth Management

*This article was originally published on Sphere.

About Sebastian Manthei

Sebastian is an accomplished sales leader with over a decade of experience driving business growth and technological innovation in wealth management. As Head of Sales, he leads the Sales Team at Assetmax with a focus on expanding the company's footprint in wealth management and private banking. Prior to this, he was VP Sales for Northern Europe at FactSet and Head of Sales for Corporate Banking at CREALOGIX Group. He started his career at Privatbank Reichmuth and Bank Vontobel working in various asset management roles.

Want to stay up to date with more news and insights throughout 2025?

Subscribe to our newsletter