Stay Ahead of Markets, Stay Closer to Clients

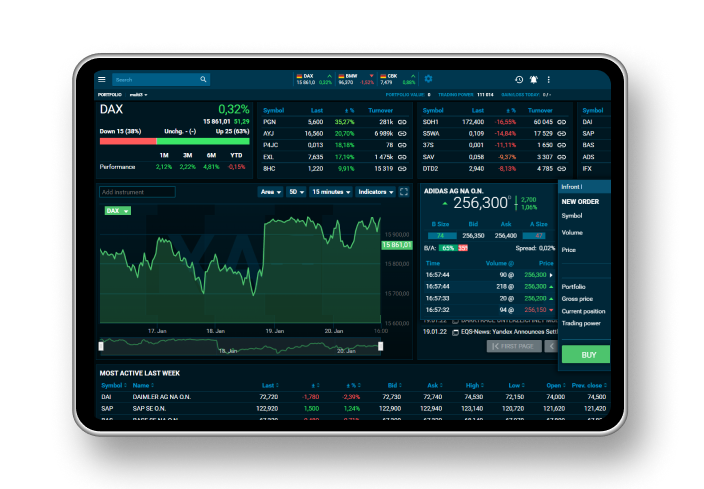

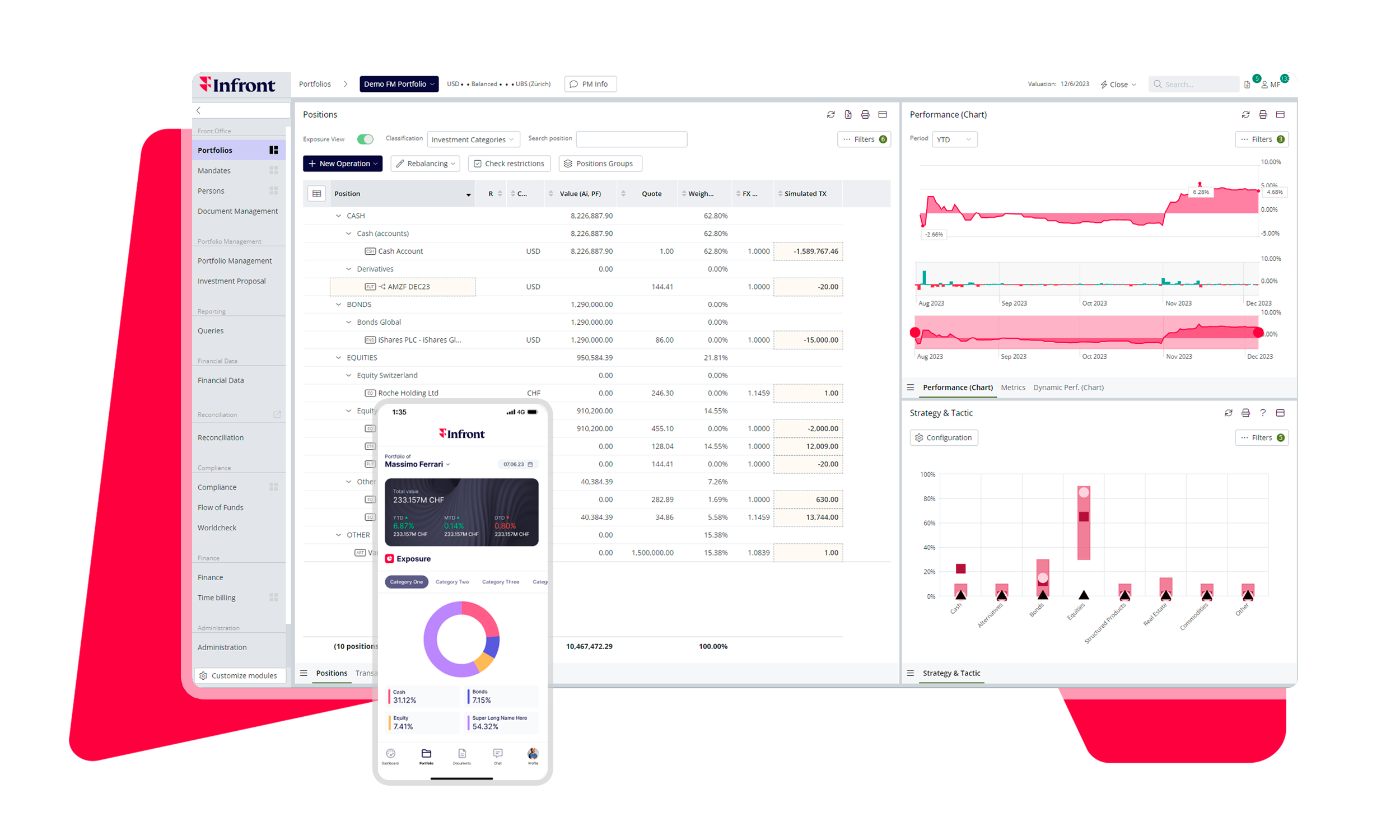

Stop wasting hours on manual reporting, unreliable data and sluggish rebalancing. With Infront Portfolio Management Solutions, portfolio managers gain the speed, accuracy and transparency needed to make confident decisions in real time.

Transform Your Portfolio Management

- Act faster: Execute portfolio adjustments with a few clicks in minutes, not hours. Respond to market opportunities as they emerge

- Consolidate portfolio data: Eliminate data silos with consolidated portfolio views. Access clean, reliable market data from a single platform that integrates seamlessly with your workflow

- Automate reporting: Generate client-ready reports instantly. Customisable templates maintain your brand identity and client expectations, while report data populates automatically

- Assetmax Clients logos variation 1

- Assetmax Clients logos variation 2

Purpose-Built for Portfolio Managers

Execute rebalancing across all client portfolios in minutes. Model portfolio rebalancing with intelligent ordering handles multi-custody environments seamlessly.

Automate fee calculations for management and performance fees. Create polished client invoices and reports that reflect your brand, delivered in your clients' preferred languages with consistent, professional formatting.

Let our data specialists handle the complexities of market data quality. From corporate action variations to position reconciliation, our team ensures your portfolio data is accurate, enriched and ready for decision-making without your intervention.

Trusted by 500+ wealth management firms

Break Free from Operational Inefficiencies

Portfolio managers face shrinking margins, rising compliance pressure and the drag of fragmented systems. See five actionable ways to streamline operations and free more time for clients.

FAQs

- MiFID II and FinSA regulation-compatible CRM with KYC, investor profile forms and document management

- AML support including flow-of-fund checks, risk calculation, PEP checks

- Suitability and appropriateness checks

- Full audit log

- EU GDPR and Swiss Data Protection Act compliant

Absolutely. The solution comes with APIs for smooth connections to your inhouse systems for easy data transfer. so you can get information in and out of the system. Of course, we would love that it if you use the complete Infront WealthTech solution including our data.