3 SEPTEMBER 2025

Compliance Costs Keep Rising – Here’s How COOs Can Fight Back

Compliance costs in wealth management have reached a tipping point, squeezing margins and slowing firms at a moment when economic uncertainty and shifting client demographics already make growth difficult. It has become one of the most urgent issues for leadership today: a daily operational burden that eats into margins, delays onboarding and holds back growth ambitions.

The numbers make the scale clear. According to a 2024 survey by EY, only 7% of firms manage to onboard a new client in under a month. Nearly 80% still rely on manual or partially automated processes, with KYC and AML checks alone consuming around 20% of the total onboarding time.

For COOs in the wealth sector, those statistics translate into longer time-to-revenue, inflated operational costs and constant pressure on compliance teams.

When compliance inefficiencies hold back growth, leaders cannot afford to treat them as a secondary concern. They need strategies that reduce cost and complexity without adding new risks.

Rising Demands, Rising Costs

Wealth managers operate in one of the most tightly regulated parts of financial services. MiFID II across Europe, FinSA in Switzerland and the UK’s Consumer Duty all set demanding expectations for transparency, suitability and reporting. And across the EU, the Digital Operational Resilience Act (DORA) has added new requirements for IT governance, cyber resilience and oversight of third-party providers.

Each new rule introduces more tasks to monitor, more audit trails and more data to manage. As an example, one update to reporting templates by the Prudential Regulation Authority (PRA) in the UK introduced over 80 new data field requirements for compliant firms.

Larger institutions may be able to spread compliance costs across bigger teams, but smaller and mid-sized wealth managers, family offices and independent asset managers must absorb the same requirements with fewer people. For many, it has become difficult to manage without rethinking the approach.

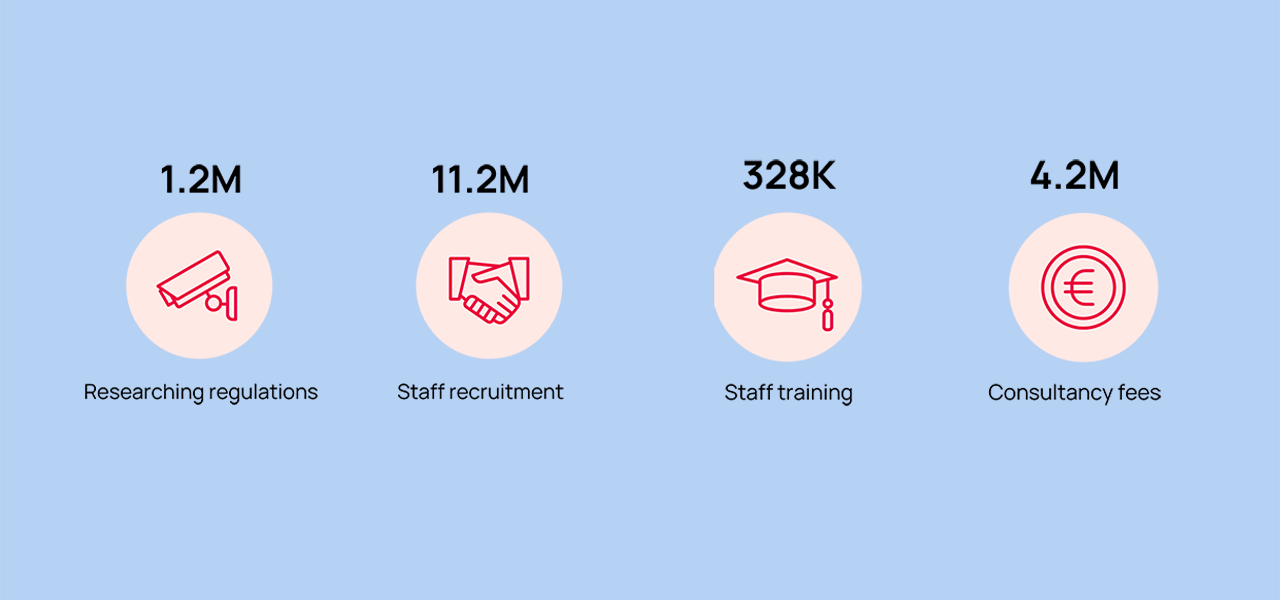

One-off costs of compliance with EU Regulation among asset managers (mean average, EUR), European Commission study

One-off costs of compliance with EU Regulation among asset managers (mean average, EUR), European Commission study

'Business as Usual’ is Not Enough

Faced with new regulation, many firms simply add more people. But this quickly becomes a cost spiral. Salaries and training rise year after year while compliance teams are left managing complex processes with outdated systems.

Training itself is a hidden cost. Each regulatory update requires updated processes and retraining, and with staff turnover the cycle repeats, wasting . Valuable time is spent teaching employees how to navigate fragmented systems instead of focusing on clients or strategy.

Legacy tech stacks add to the burden. Many were not designed for today’s regulatory environment and lack automation. Instead of streamlining compliance, they create silos of data and require manual workarounds that add complexity. And with each new rule, the problem grows bigger.

The result is higher costs, longer onboarding and greater risk of human error. And the consequences of non-compliance are severe. Analysis by Fintech Global shows the financial impact of non-compliance is around 2.7 times greater than the cost of maintaining a robust compliance programme. For COOs, the message is clear: doing nothing is far more expensive than investing in better systems.

The COO’s Path to Compliance Efficiency

Targeted Support is more than a regulatory adjustment. It is the FCA’s way of giving you a growth lever. For too long, advisers have had to choose between offering only generic guidance or shouldering the full burden of regulated advice. Targeted Support creates a middle ground: lighter-touch, group-based recommendations that let you engage people you would normally have to leave on the sidelines.

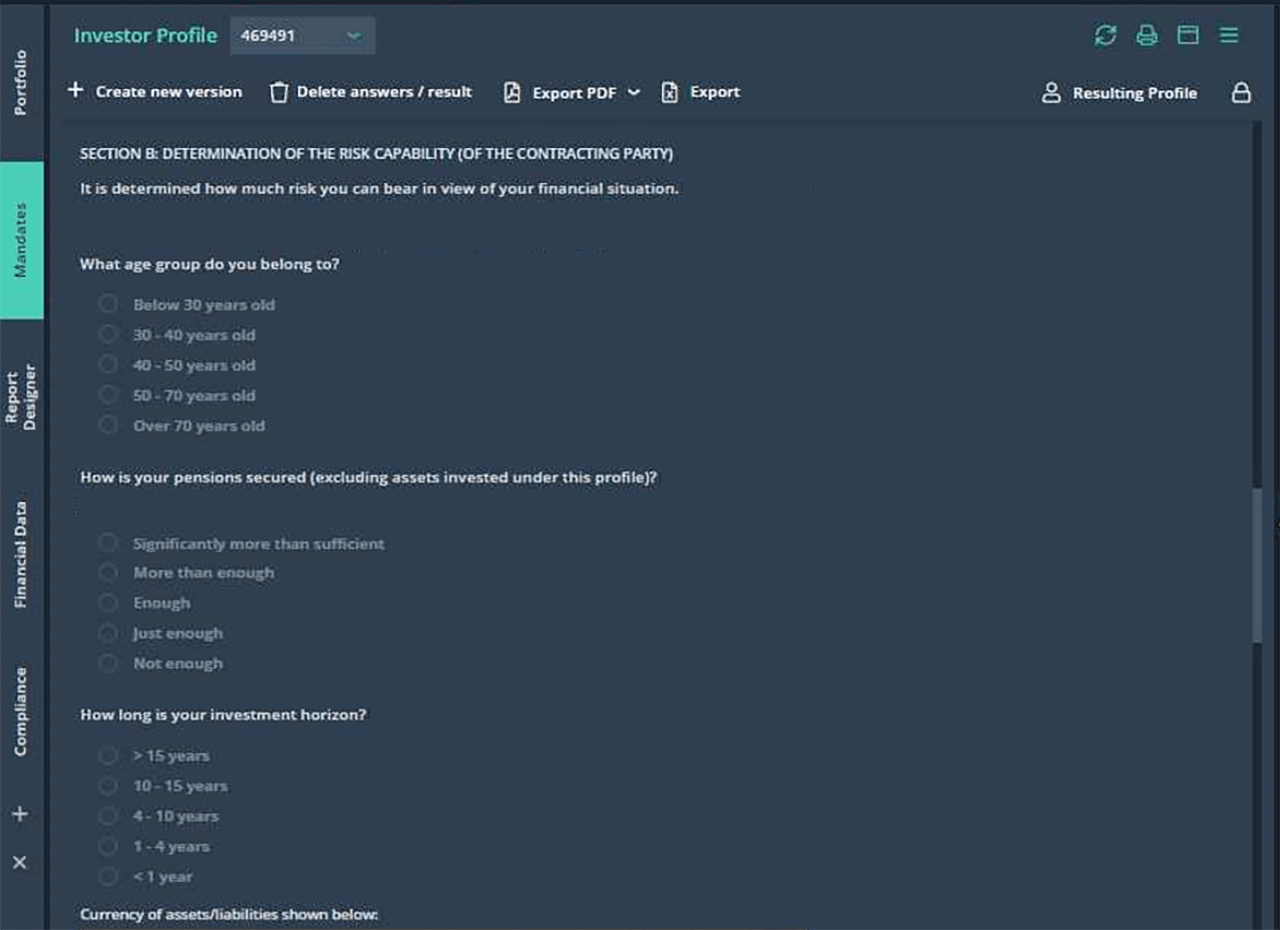

Automated investor profiling forms reduce manual workloads

Automated investor profiling forms reduce manual workloads

- Embed compliance in daily workflows

Instead of treating compliance as an additional layer, modern PMS platforms integrate regulatory requirements into everyday processes. Infront Assetmax includes MiFID II and FinSA-ready CRM, suitability and appropriateness checks, and automated investor profiling. By embedding compliance in the client lifecycle, firms reduce manual duplication and ensure regulatory standards are met at every step. - Automate onboarding and AML/KYC

The EY survey highlights onboarding as a major pain point. Automated KYC and AML reduce the burden significantly. Infront Assetmax supports flow-of-fund checks, PEP screening and risk calculation, all built directly into the system. Automation not only accelerates onboarding but reduces training needs and the risk of error. What once took weeks of repetitive manual effort can be achieved far faster with consistent accuracy. - Standardise data and simplify audit readiness

Fragmented data creates audit nightmares. A unified PMS addresses this by consolidating documentation, applying consistent data standards and providing a full audit log. This makes it significantly easier to evidence compliance quickly and confidently when regulators request proof. As one COO explains:

“Our FINMA licensing and our audits since 2019 have been made much easier thanks to Assetmax’s analysis capabilities.” – Niklaus Arnosti, COO, Consilior AG - Build resilience with the cloud

Regulators are increasingly focused on operational resilience, with DORA set to enforce tougher requirements. Cloud-based PMS solutions allow COOs to meet these demands more easily. They reduce reliance on fragile on-premises systems, ensure scalability and offer built-in compliance with emerging frameworks. As one client put it:

“With Infront's Cloud platform, I am already DORA-compliant and don’t have to worry. The professional solution is already helping me to fulfil all requirements and look to the future with confidence.” – Helmut Weber, Managing Director, STRATAV GmbH - Reduce technical debt and vendor sprawl

Wealth managers often juggle multiple platforms for research, trading, risk and reporting, driving up cost and complexity. Consolidating with a provider that offers integrated services simplifies the stack, reduces overhead and enables straight-through processing. Less training, fewer errors and a smoother experience for staff and clients alike.

Conclusion: Turning Compliance into an Efficiency Driver

Compliance costs are not going away. Regulators will continue to raise expectations and clients will continue to demand faster onboarding and transparent reporting. But COOs do not have to accept compliance as a permanent roadblock.

By embedding regulatory checks into workflows, automating AML and reporting, and leveraging cloud-ready PMS platforms, compliance becomes part of a more efficient and scalable operating model. The costs of compliance may rise, but the costs of non-compliance rise faster.

For COOs of wealth managers, family offices, and IAMs, the choice is stark. Keep struggling with manual systems and rising overhead, or turn compliance into a driver of efficiency and resilience.

You’ve seen how compliance costs are rising. But the real question is: how are other COOs managing to stay ahead? Discover what they’re doing differently.